2025, Issue No. 8

Quote of the Day

Cash flow is king. If it doesn’t cash flow, don’t do it.

— Grant Cardone

Letter to the Investor

Dear Investor,

That’s a Grant Cardone quote, and while his delivery isn’t always my style, the principle is solid. Especially right now.

In a market where rates hover near 7%, investors have to look beyond hype and ask the real question: does the deal work today?

I’m seeing more and more borrowers focus less on projections and more on present-day performance. Not chasing appreciation, not banking on refi timing, just making sure the deal supports itself from day one.

That’s what this issue is about.

From credit-based loan structures to construction strategies that actually make sense in this environment, we’re talking about how to keep moving, without losing your footing.

If it cash flows, you can scale it.

And if it doesn’t, maybe it’s not the right season, or not the right structure.

And while we’re talking strategy, I also want to pause and acknowledge the meaning of this weekend.

Memorial Day isn’t just a long weekend, it’s a moment to reflect on the cost of freedom, the weight of service, and the privilege of opportunity. The fact that we get to invest, build, and create futures is, in part, because others made sacrifices we’ll never fully see.

So this week, I’m building with gratitude. And I hope you are too.

This newsletter is my weekly take on lending, markets, and mindset, from someone who still loves helping people get deals done.

Thanks for reading.

Keep investing. Stay Timeless.

Have a great start off to your week.

Alanna Avalone – Private Lender

Investor Corner: The Reality of a 7% World

Rates have hovered around 7% for a while now, and for those of us who work in lending every day, it no longer feels like a spike, it feels like the baseline.

This isn’t 2021. And it’s not a temporary pause. It’s a market that’s recalibrated.

But even in this environment, I still see real estate investors closing deals, quietly, consistently, and with intention.

What do they have in common?

They’re not chasing perfect timing. They’re making the current math work.

They understand that rent demand is holding, and they build around what’s available today, not what they hope shows up tomorrow.

Some are using fixed DSCR loans to lock in cash flow. Others are building and repositioning with bridge. Many are simply moving forward in smaller, more strategic ways.

It’s not about rushing. It’s about staying active, staying ready, and remembering that the work done in high-rate seasons often pays off when things soften later.

Capital Markets Insight: May 2025

Where money is flowing, what lenders are favoring, and how to position your next deal.

Rental growth is starting to stabilize nationwide, slow, but steady.

The national median rent rose 0.5% in April, making it the third straight month of increases. But year-over-year, rent growth still sits at -0.3%, signaling a cooled but consistent recovery. Meanwhile, effective rent growth is up 1.7% over the past 12 months, and rents remain over 20% higher than pre-2020 levels.

We’re still operating in a market that favors well-located, stable rentals, especially in regions with supply constraints and rising household formation.

But here’s the curveball:

Mortgage rates are still hovering near 7%, and that’s no accident.

Our 30-year fixed rate is directly tied to the 10-year Treasury, which has just spiked again.

Until that yield comes back down, expect long-term rates to stay sticky, and structure accordingly.

Bottom line:

Rental demand is resilient, but leverage is tightening.

Build with today’s rates in mind. And position for a better refi tomorrow.

Loan Product Highlight: DSCR Loans Built to Match Your Numbers

When it comes to DSCR lending, the structure is flexible, but it’s all a trade-off.

The rates and LTV aren’t just tied to your credit score. They’re tied to how the property performs.

It’s a balance between borrower profile and deal strength.

Here’s what to know:

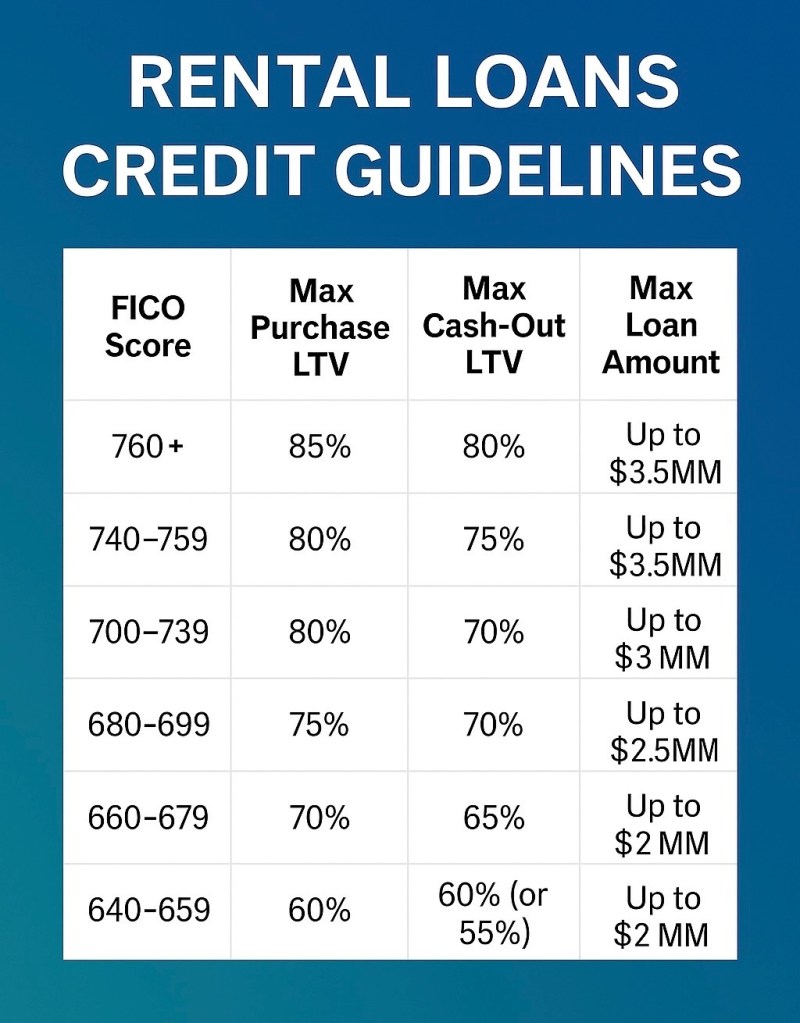

A higher LTV means higher risk—so the rate and fees will reflect that. A lower LTV, or a stronger DSCR ratio, typically unlocks better pricing. Minimum FICO: 640, but better terms start at 680+ Minimum DSCR: 1.00x, but ideal pricing kicks in at 1.15x+

Whether you’re refinancing into long-term debt or acquiring a cash-flowing rental, the DSCR loan is designed to match the deal, not force it.

It’s not one-size-fits-all.

It’s structure for the real world.

Single Property Rental

Term Loans – Residential 1–4 Units

LOAN AMOUNT

Min: $75,000

Max: $3,500,000

PROPERTY TYPES

• Single Family Residences (SFR)

• 2–4 unit properties

• Warrantable condos

• Townhomes

• PUD

TERM LENGTH

• 30 Years

• Various Prepay Penalty Options

LOAN TYPES

• Fixed rate and Adjustable rate options available

• Partial IO and Fully Amortizing options available

MAX LTC

• If owned < 3 months, 80% of Total Cost Basis

MAX LOAN TO ARV

• Up to 85% on Purchase, Rate & Term Refinance

• Up to 80% on Cash Out

EXPERIENCE

• Not Required

FICO

• 640 Minimum

RECOURSE

• Full Recourse only

LEASE REQUIREMENTS

• Leased Units: Lower of (i) In-Place Rent & (ii) Market Rent

• Unleased Units: 100% of Market Rent

Alanna Avalone – Private Lender

305-537-6443

contact@alannaavalone.com

alannaavalone.com

Sponsored by Brickell Int’l – Lending Nationwide

Weekly Feature: Trump’s New Tax Bill. What Real Estate Investors Should Really Watch?

On May 22, 2025, the House passed what’s now being called the “One Big Beautiful Bill”—a sweeping piece of legislation backed by President Donald Trump. While the headlines focus on politics, real estate investors should be paying close attention to what’s actually in the fine print.

Here’s what matters most if you own or invest in property:

1. SALT Deduction Cap Raised

The State and Local Tax (SALT) deduction cap could jump from $10,000 to $40,000 for individuals earning up to $500,000.

What it means:

If you own real estate in high-tax states like New York, California, or New Jersey, this could put real dollars back in your pocket.

2. 1031 Exchanges Stay Intact

The bill preserves Section 1031 like-kind exchanges, which allow you to defer capital gains taxes when exchanging investment properties.

What it means:

Portfolio growth and wealth building just got more stable. No need to rush repositioning strategies or sacrifice timing.

3. Mortgage Interest Deduction Protected

The mortgage interest deduction remains in place.

What it means:

Whether you’re leveraging DSCR loans or refinancing a primary home, your debt still works for you at tax time.

And a Watchlist Item:

Privatization of Fannie Mae & Freddie Mac

Trump is floating the idea of moving these giants out of government conservatorship.

What it could mean:

Less regulation, but potentially higher mortgage rates—especially for traditional buyers and developers reliant on agency loans.

Bottom line?

If you’re a real estate investor, this bill (for once) leans in your favor. But as always, read beyond the headlines, and structure with strategy.

Need help packaging a file? My team underwrites with you.

We are Direct Lender for Residential Investor Projects.

We do NOT offer loans for homesteads (primary residences), or rural.

For projects that don’t align perfectly with our requirements, we collaborate with other lenders to explore financing alternatives.

— Typically booked out 2-3 days. Secure your spot now.

Broker Collaboration

We know brokers are the key to getting deals done. We provide the capital, underwriting, and servicing to help you close more deals with ease, backed by private capital.

Your deals, our capital. Focus on origination, we’ll handle the rest.

— If you’re a broker looking for a reliable lending partner, let’s connect!

My Gift to You: Business Credit That Grows With You

Need working capital to kickstart your next project?

I’m sharing a powerful funding tool I’ve personally used to build my business.

Chase for Business offers a flexible line of credit with:

- 0% interest for the first year

- No annual fee

- Ideal for strong borrower profiles (700+ credit)

Start with $25K–$100K+ and watch your credit line grow as your business scales.

This is the kind of smart capital that works for you, not against you.

— Consider it my gift to help you move faster and smarter.

AI-Powered Credit Boost

Dovly AI is shaking up the credit game with the first all-in-one AI credit engine that builds, fixes and protects credit, empowering all Americans to boom financially – 100% free.

— Our investors are using Dovly AI to improve personal credit for smoother approval.

Invest Smarter with Robinhood

Many real estate investors are diversifying into the stock market.

Start small, earn passively, and complement your real estate strategy with market-based gains.

— Get a free stock on me.

Leave a comment